First decide if you will count it at all

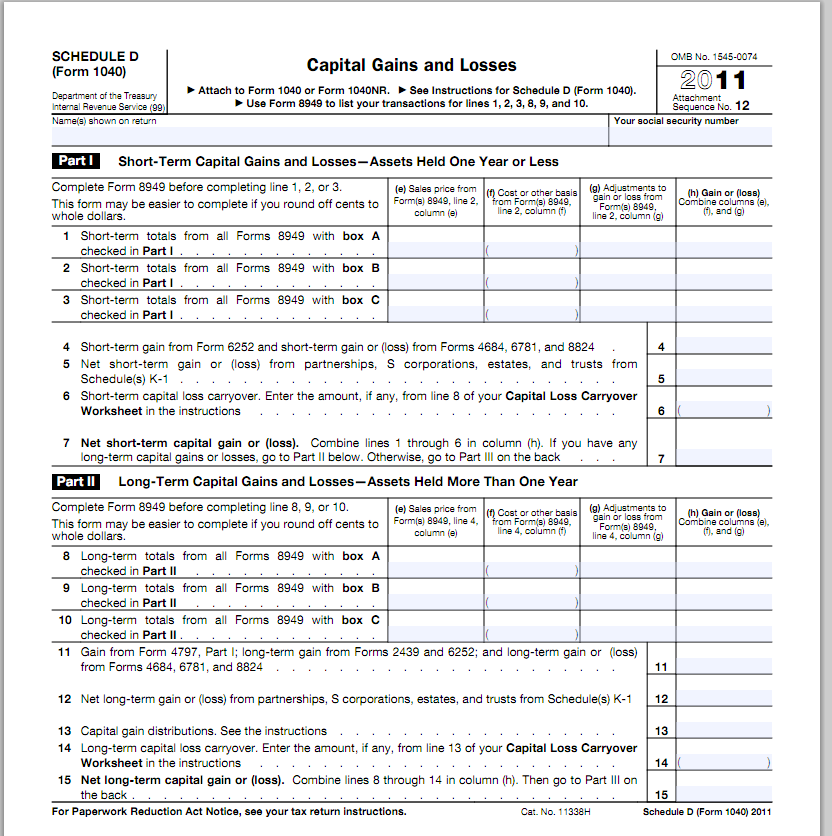

See this post on ‘Lending on Asset Conversion instead of Income‘.Here is the form

Click on the image to zoom.

Beware non-cash entries

Line 12 (2011 Form 1040) is a pass-through from a K-1. It is not cashflow to this borrower, although now you know you’ll need to ask for the k-1(s) to find cashflow from them. Or perhaps the full source return (1065 or 1120S) to determine cashflow available from the entity to your borrower/guarantor.

Line 14 (2011 Form 1040) is a carryover. It is a long-term loss from a prior period that was not allowed because they were over the limit for capital losses. You should have counted this loss against them (if at all) when they actually incurred it.

Where is the cashflow if it is Real Estate?

It is not here. We can see the proceeds in column d (2011 Form 1040) but since we have no way of knowing what the amount of the underlying mortgage or contract was that had to be paid off, we are missing critical information.

If not the tax return, where do we get the essential information?

Use the tax return for the list of what Real Estate was sold. Then request the closing statements so you can determine ‘cash to seller’.The rest of the story…

If you decide to give your borrower/guarantor credit for cash from real estate sales, it is likely you also need to count against him or her the cash invested in new real estate purchases. No where on the tax return does the borrower/guarantor list purchases. That is because, once again, the IRS does not care. But we do.

Look to the borrower’s application to see what Real Estate they own. Find the RE acquired in the year in question. Ask for the closing statement and count against cashflow the ‘cash from buyer’. Now you’ll have a complete picture of the cash in and out from their RE activity.