I wrote the AllBusiness.com article linked below during the recession BEFORE the Great Recession of 2008/2009. And now we are in the Pandemic Recession. Turns out what was true three recessions ago is true today.

What is different this time

Before you click through to read the warning signs of past recessions, let me update the list for this pandemic recession caused by Covid-19:

- Consider the industry sector, location, and business characteristics

- Was this business essential and open during the shut-down?

- If not essential, was this business able to pivot to a work-from-home workforce and maintain productivity?

- Was this business able to shift to other revenue sources (take-out food, online training)?

- Consider the pre-recession strength of the business

- Their recent history does not predict the future, but is critical to your judgment as to whether the business was already on the ropes or has the stamina to withstand the downturn and recover.

- Where was the company in succession planning?

- An owner who planned to retire five years from now may not want to go through the challenges of this recession and the years of hard work to recover.

- If there was a plan to sell the business or transfer it to the next generation, is that still in play? On hold? No longer viable?

Some warning signs have not changed

Improve your credit analysis skills

Lending and credit professionals must navigate through the pandemic recession, bring judgment to the loan origination and loan modification decisions, and find ways to serve their borrowers, their financial institution and their communities. That is a tall order.

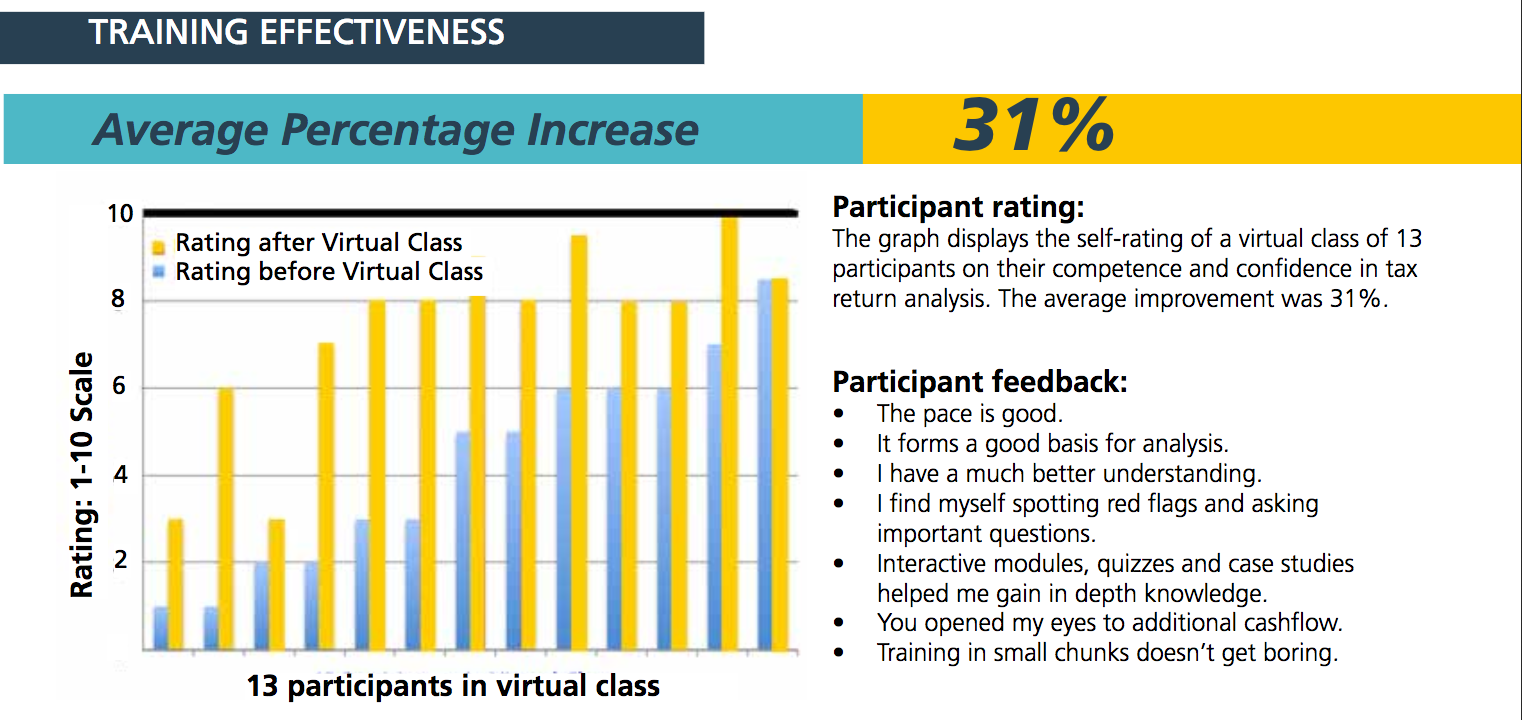

Our tax return analysis training did not shift from in-person to online this month. We added a robust online training option ten years ago. See the results below:

I will recommend the course {for teams} because it will keep our approach to Global Cash Flow consistent.

Donald Volkman, Chief Credit Officer

MegaBank

Learn more at www.LendersOnlineTraining.com.