What is short-term and where do I find it?

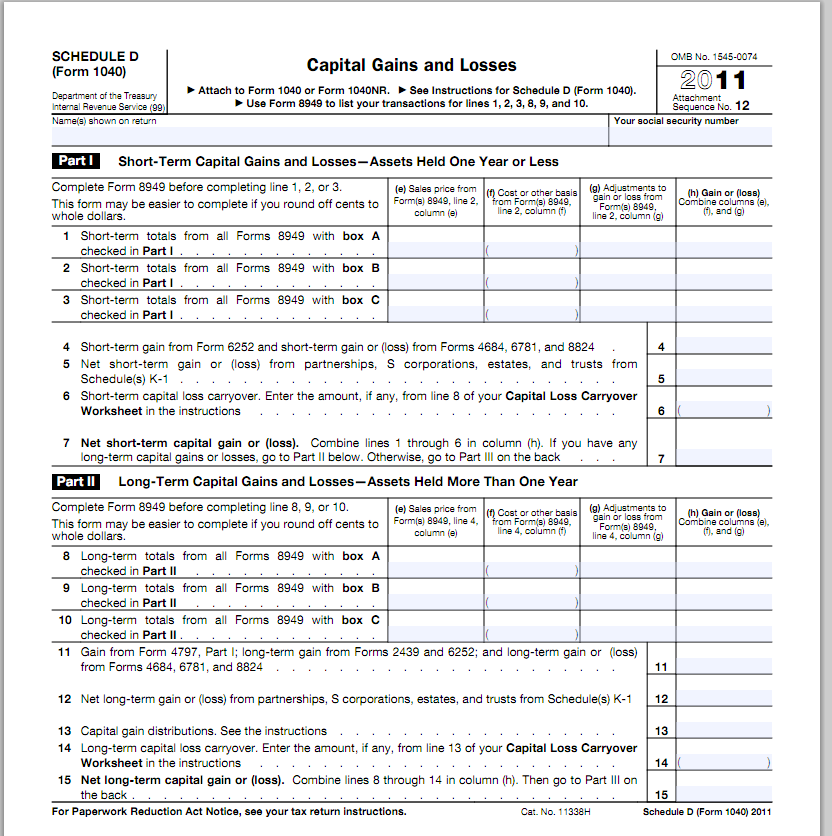

Schedule D, Part 1 is where you’ll find short-term capital gain or loss. This is related to assets held one year or less.

Here is the form

Click on the image to zoom.

Beware of non-cash entries

Line 5 (2010 Form 1040) is a pass-through from a K-1. It is not cashflow to this borrower, although now you know you’ll need to ask for the k-1(s) to find cashflow from them. Or perhaps the full source return (1065 or 1120S) to determine cashflow available from the entity to your borrower/guarantor.

Line 6 (2010 Form 1040) is a carryover. It is a short-term loss from a prior period that was not allowed because they were over the limit for capital losses. You should have counted this loss against them (if at all) when they actually incurred it.

Where is the cashflow?

Given the assets are held one year or less, and backing out any non-cash items (see paragraph above), the gain or loss in column f (2010 Form 1040) is also the impact on cashflow.

Should I use it in recurring cashflow?

That is another question altogether. Take a look at this blogpost on ‘Lending on Asset Conversion instead of income‘.