Gena asks:

How do you view long term capital gains versus short term capital gains in using tax returns to determine cash flow? Some bankers include only the gain on the short term sale of stock in their cash flow but on the long term include the actual sale price for cash flow analysis. I was always told to take only the gain or loss from the Schedule D. Which is correct?

Linda Says:

I go through several steps regarding Capital Gains as to whether and how to count it.

Step One: Guidelines

What are your guidelines? Some financial institutions have hard and fast guidelines.

- We always use capital gains/(losses).

- We never use capital gains/(losses).

- We only use capital gains/(losses) if needed to qualify.

- We consider the stock portfolio as liquidity, but do not use that gains/(losses).

Step Two: Historical or Projected

Are you determining historical or projected cash flow? If historical, it is helpful to consider the cash flow provided by capital gains transactions because sometimes it explains where (the heck) they got the money to purchase equipment, invest in the business, pay the owners or build up liquidity.

If you ever find that it just does not seem there is enough cash flow generated from operations to do what they are doing, see if there were capital gains transactions. Especially if there were taxable losses, they can be camouflaging actual positive cash flow.

Step Three: Need it to Qualify?

If you are projecting cash flow, do you need the cash flow from the capital gains to qualify your borrower?

If not, consider leaving them off and adding a note in your write-up: “If more qualifying income is needed, consider $9,757 proceeds from long-term capital gains.”

If so, determine cash flow available using Step Four.

Step Four: Convert Taxable Income/(Loss) to Cash Flow

If you are projecting cash flow and need the capital gains to qualify, or you are doing a historical cash flow analysis, you must determine the cash flow, not the taxable income.

First, I determine if there is actual cash flow on Schedule D. Anything on a carryover or a K-1 pass-through line is non cash. If the entire amount that flowed through to the front page of a 1040 or the Schedule K of a 1065/1120S is on a carryover or k-1 line, there as no cash transaction. Ignore it.

Second, I consider if I need additional documentation or am comfortable with a shortcut. If the shortcut, do my guidelines allow for that.

Third, If the shortcut is acceptable without additional documentation, i use the gain/loss in the short term section and the proceeds in the long-term section. Anything in long-term was bought long enough ago that the cash proceeds this year is the impact on the checkbook.Admittedly, this is a simplifying assumption. Those in the other camp, suggesting you use gain/loss every time would be right over the fullness of time. But imagine a borrower who is past their capital assets accumulation years and is in sell-off mode. This could be a retired couple, for example. The proceeds is the best indicator of the impact on their cash flow. The investment was made long ago.

Fourth, if you are relying heavily on capital gains, I recommend you get back-up documentation. Keep in mind that what you see in the tax return is what was sold, but there is no requirement in the tax return to list what was purchased. You can imagine a borrower calling their broker and saying “Sell the Amazon stock and buy Apple stock.”

While they likely have a gain on the Amazon stock, they did not use it for cash flow but rather put it right back into something else. Only with the brokers statement could you see if there is net positive cash flow to the borrower.

And if it is real estate transactions, all bets are off. The likelihood is that the borrower used some of the proceeds to pay off an underlying mortgage, note or contract. The proceeds will not be even a good guess as to cash flow. You need the closing statement to see cash to seller. And you need to look at the Real Estate Owned statement on their application to see if they reinvested any of the cash proceeds into other properties.

Too much information?

Gena, that almost feels like more than you wanted to know. I was pretty sure, though, that ‘It depends’ was not what you were hoping for.

But if it just whet your appetite, take a look at the Capital Gains Module in our Lenders Online Training. You can purchase just the Capital Gains Module, if you like.

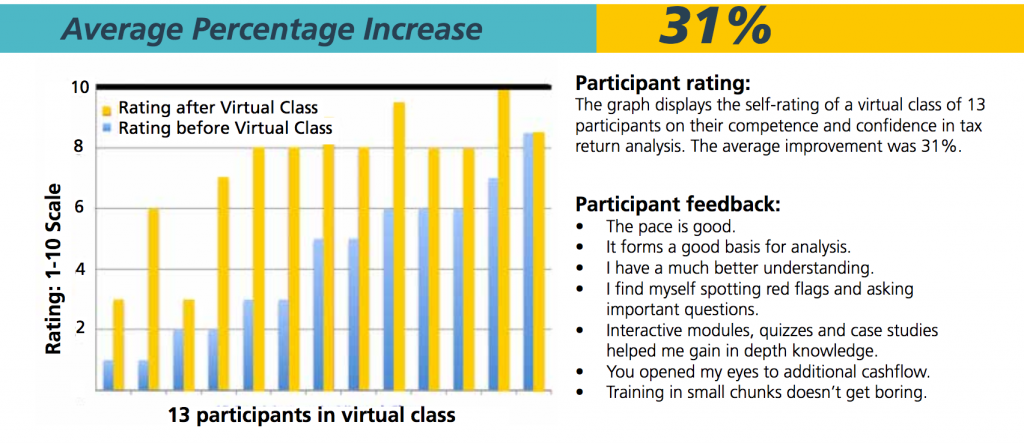

Or consider the 31% increase a recent team accomplished in the full online training. You can purchase access to all 35 modules, three case studies and seven live webinars, your choice.