It is great to hear that things are looking up…but for whom? Community banks and credit unions engaged in member business lending are most interested in small- to mid-sized business.

Government stimulus, greater exports and less-severe reductions in business inventories have

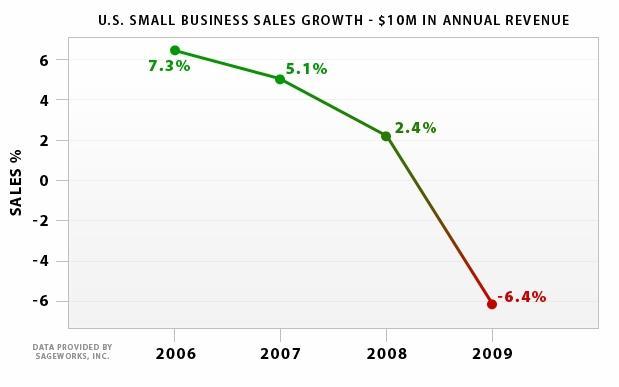

been credited with the growth, but data from Sageworks, which compiles

financial information on privately-held companies, paints a far bleaker

picture for small businesses.

U.S. Small Business Sales Growth/(Decline) through 4th Quarter 2009

What is happening…

- In your part of the country?

- In your target industries?

- With your clients?