As you assess the loan requests from your business borrower’s to gear up for the recovery, a conversation about their strategies will help you decide if they have a good plan. Economist Bill Conerly PhD shares some great insight on how business can do well in an upswing.

I had dinner with Bill (my favorite economist) this week. When he says things are looking up, I believe him. Of course it helped that he agrees with me, too. Business lending will be tougher in the recovery as the pre-recession years are dropping off the historical radar and the worst years of the recession are coming into our lending calculations.

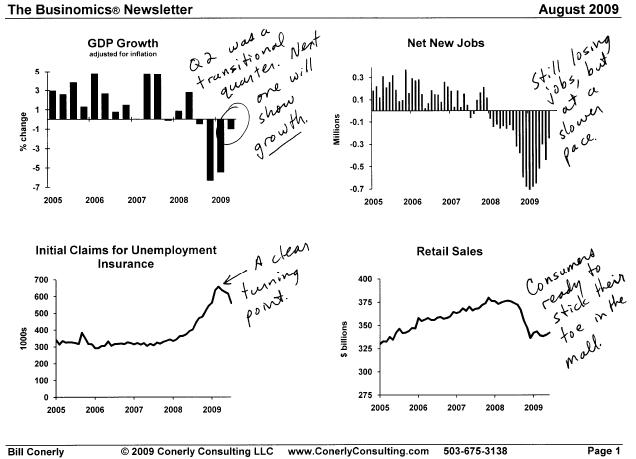

I like Bill’s ‘Conerly on the Economy’ monthly newsletter with easy to

understand graphs and his comments scribbled on the side. If you want a

quick picture each month so you can talk business with your borrowers, this is a great one. (Sign up here if you want your own copy.)

These were some of his August charts. Click on the image below to enlarge it.

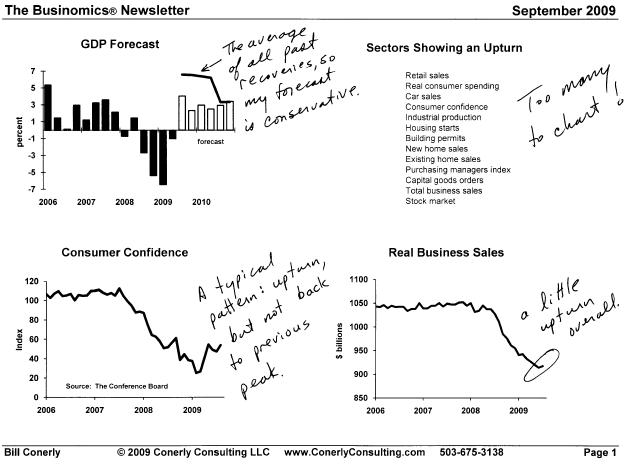

Here is September 2009! The RECOVERY is officially in progress. Click on the image to enlarge.

Click through to the full September 2009 newsletter for other graphs including more detail on Oregon and Washington.

Click through to the full September 2009 newsletter for other graphs including more detail on Oregon and Washington.

Okay, Bill, I am convinced. So what should business do next?

Read Bill’s take on your business borrower’s best strategies in the recovery. He gives specific advice on:

- Revving up the sales force

- Cost-saving ways to bump up inventories and replace equipment

- Focusing on core business if resources are limited or your bank is still restricting credit

- If possible, look to peripheral opportunities

- Lock in lower rents

- Buy a competitor

- Hiring strategies to rebuild the workforce

Bill finishes with this:

“The

turnaround in the economy offers the potential for savvy companies to grow

market share while lowering costs. It’s

not time for business as usual.”

What other suggestions do you have for businesses to do well in the recovery?