First, decide if you will count it at all.

See this post on ‘Lending on Asset Conversion instead of Income‘.

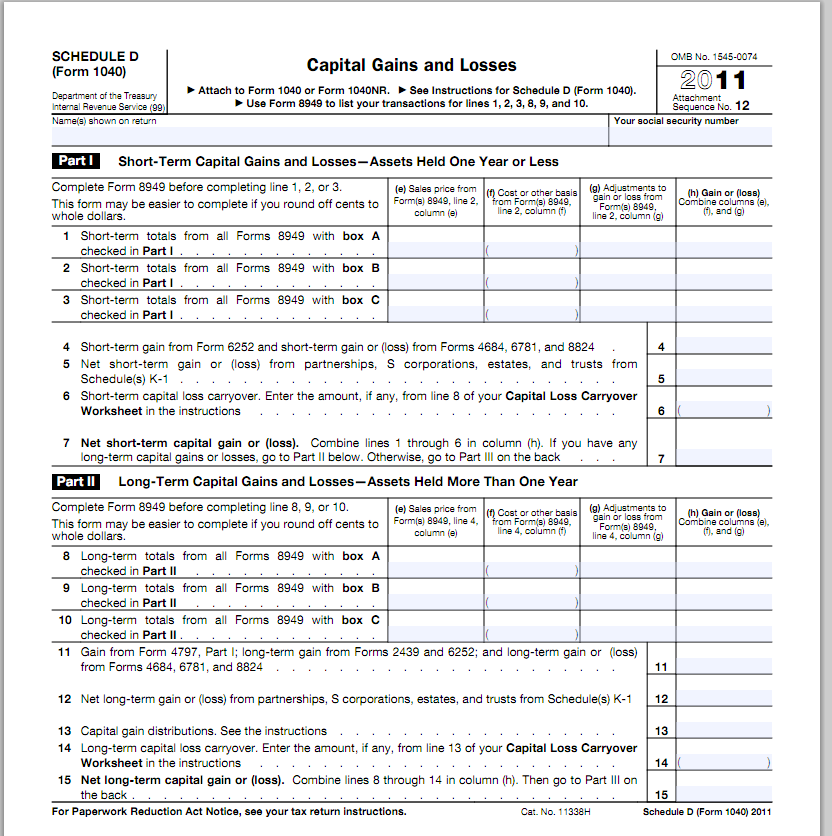

Below is the form. Click on the image to zoom.

Beware non-cash entries

Line 12 (2011 Form 1040) is a pass-through from a K-1. It is not cashflow to this borrower, although now you know you’ll need to ask for the k-1(s) to find cashflow from them. Or perhaps the full source return (1065 or 1120S) to determine cashflow available from the entity to your borrower/guarantor.

Line 14 (2011 Form 1040) is a carryover. It is a long-term loss from a prior period that was not allowed because they were over the limit for capital losses. You should have counted this loss against them (if at all) when they actually incurred it.

Where is the cashflow if it is Stock?

Well, it is not the gain or loss. Let’s say they bought stock in 1995 for $100,000 and sold it in 2011 for $80,000. Gain or loss? How much?

The tax return will properly show a loss of $20,000. But what happened in the checkbook in 2011?

Their cashflow increased by $80,000! So a loss in a 1040 can actually camouflage a real increase in cashflow.

The rest of the story…

But we are missing an essential piece of the puzzle. The taxpayer does not report the purchases of stock on the Schedule D. So in the example above, you can spot the $80,000 in the column for proceeds. But you don’t know if they just called up their broker and said: “Sell XYZ stock, take the $80,000 proceeds and by ABC stock.”

If you decide to give your borrower/guarantor credit for cashflow from stock transactions you will need to get a copy of their broker’s statement to determine the real cash inflow or outflow for the year in question.

What if your guidelines say otherwise?

Lenders in my Tax Return and Financial Statement Analysis workshops hear me say it often: “Guidelines rule”. But I also say: “Guidelines are guidelines”. You need to know if your guidelines are hard-and-fast rules or a common starting point.

If your guidelines allow you to use a figure from Schedule D, whatever it is and whatever line it comes from, you are making a simplifying assumption. If you need to know their real cashflow from stock transactions the Schedule D just alerts you that there were transactions. The broker’s statement will tell the story.