What is changing this year?

You may know that the tax law does not take effect until January 2018, so

- why would you see changes in the 2017 return?

- what difference will that make to a loan officer or credit analyst calculating global cash flow from the tax returns?

- what should you tell your borrowers to be sure they take advantage of the new opportunities in the tax law?

The short answer

I am well aware that some of my readers want me to cut to the chase and give you the answer, first. Others of you find that by having a better understanding, not only can you make better decisions, but you can have more informed conversations with your business borrowers. Hard to come across as a trusted advisor when it sounds like you do not have a clue on something that they are hearing about on the news.

The short answer: Many of your business borrowers should meet with their tax professional before year end. The professional will have an idea if that taxpayer will be eligible for some of the new provisions of the Tax Cuts and Jobs Act (TCJA) and, if so, how to maximize them. This gives you a great reason to touch base, always a good thing. And some of these changes might need to be in place from the beginning of 2018, therefore requiring a trip to the tax professional by October 2017 at the latest.

Some of the tax professionals will advise a change in legal type of entity. Perhaps they will focus on increasing wages without increasing expenses (read more about this below). Or they may even recommend splitting a business so that the portion that is not a ‘specified services’ business (see more below) does not eliminate a significant deduction available because of the rest of the business, which might not have the same limitations.

Ok, I admit it, I already went over the length required to call that a short answer. My concern is that a lender will see changes between 2017 and 2018 and think they actually mean something significant about the operation of the business, rather than a totally legitimate maneuver to maximize a tax break.

QBI is the talk of the town!

Sometimes called QBI (the Qualified Business Income deduction) and technically called Section 199A, this is the 20% deduction from business income allowed to all the business entities except for the C Corporations (C-Corps). If the congress had not followed suit with a comparable reduction in taxes for the non-corporate entities, there would have been gnashing of teeth and a lot of changes to the C Corporation form of business just to get the tax break. Enter the QBI.

The QBI impacts income from pass-through entities and sole proprietorships.

Owners of sole proprietorships, LLCs (not choosing to file Form 1120), S Corporations and Partnerships will potentially benefit from the QBI. There are limitations, which also leads to some of the maneuvers tax professionals might recommend.

The first hurdle, total taxable income of the owner

If the owner’s taxable income is below $315,000 Married-Filing-Jointly (MFJ) or $157,500 Single they will generally enjoy a 20% deduction. (Tax experts use the word ‘generally’ when there can be some exceptions. You know I am not giving you specific tax advice, right?) So with an owner below those thresholds, the calculation is fairly straight forward and I would not expect a lot of maneuvering on the tax returns, either by changing type of entity or changing how people get paid, in order to maximize the deduction.

What about higher-earning taxpayers?

If over the threshold above, several limitations kick in. The QBI deduction is not allowed for ‘specified services’ which include health, law, accounting, consulting and ‘any trade or business where the principal asset is the reputation or skill of one or more of its owners or employees’. I predict there will need to be more guidance on just what that means.

Once that hurdle is jumped, and it is determined the business is not a ‘specified service’ business, the next hurdle is the limit on the deduction. It is limited to the greater of 50% of the wages paid or the sum of 25% of the wages plus 2.5% of the unadjusted basis of qualified property. I am SO SORRY if I just lost you in the weeds.

So what does all this mean?

If over the threshold, I can imagine efforts to maximize the deduction by paying more wages. You might think that would be counterproductive, as you would have to pay more wages. But what if there is a sole proprietorship in which both the husband and wife work. Perhaps one of them has been listed as the sole proprietor and the other was not reflected in wages. That is totally acceptable. But to maximize the QBI if their taxable income is over the threshold amount, it may make sense to actually pay the wages. This will not impact their overall picture because the wages deducted on the Schedule C or F will be added to Line 7 on the front page of the 1040. But if their QBI is higher because they have higher wages, they may come out ahead.

The same is true for a company that has been paying independent contractors. Contracted services have often been more beneficial than hiring employees because the business does not pay payroll taxes on the contract labor, and can be more flexible in needed changes in their work force. But if recharacterizing these payments as wages will increase the QBI, it could overshadow the increased payroll taxes they will pay.

To wrap it up

- Recommend your borrowers see their tax professional by early this fall.

- Expect changes in entities, both the type of entity and even the breakup into several entities.

- Expect changes in how people are paid but do not assume it means the company is expanding or contracting. If in doubt, ask about changes.

And expect nuances and clarifications after this blog post is written. It is not my intent in this blog post to turn you into an expert on TCJA or QBI. My readers are loan officers, credit analysts, underwriters and others lending to business and farming operations and other complex borrowers. You’ll see changes. You need to understand it well enough to know it is an issue and direct your borrowers to their tax professionals. And you need to be able to distinguish the differences you will see between the 2017 and the 2018 returns as either significant business changes or changes to maximize tax breaks.

Time for (re)training on tax return analysis?

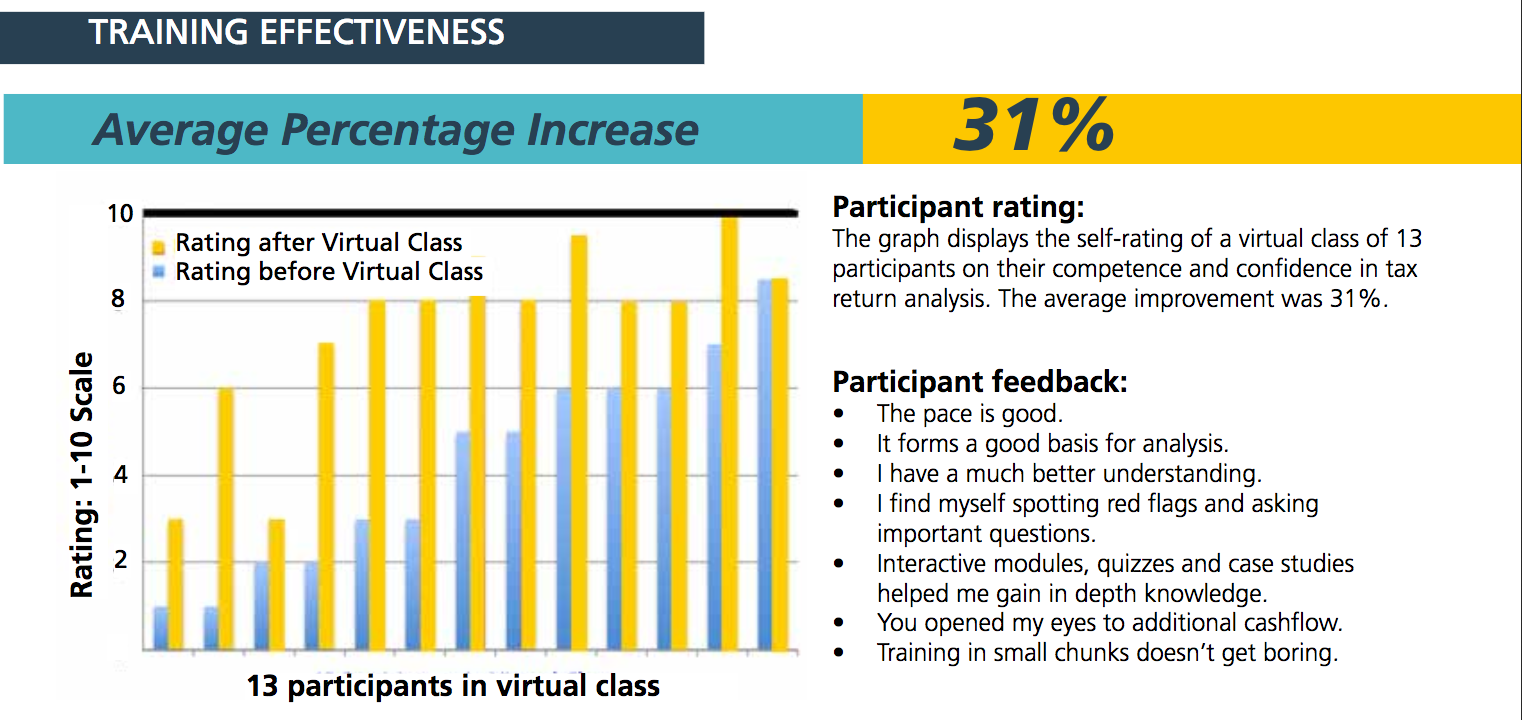

I do not generally pitch my training in the body of a blog post, but this time I am making an exception. The impact of the TCJA is just an example of how much more complex tax return analysis has become in the last ten years or more. Couple that with a ‘recovery’ that has been slow and another credit disruption likely just around the corner, and for many it is time to improve their ability to pull qualifying income, understand the borrower, spot red flags, spot changes that are not red flags, ask good questions, make good loan decisions and document your thinking…at a much higher level.

Learn more at the training website, www.LendersOnlineTraining.com and get the results others have obtained.

I am a star!

If you are new to me, you’ll think I am bragging. If you and I go way back, you’ll get a kick out of this. I presented two sessions at an AgLending Symposium with 155 in attendance in Columbia, MO last week. Before I got up for the session on Rough Seas Ahead! A Kayaker’s Guide to Credit Risk Readiness one of the people came up out of the audience. Carla told me that she had not paid attention to the agenda until she arrived. When she saw I would be speaking, she said to her colleagues “Look at this, Linda Keith will be here”!

Then, before I presented the session the next morning on K-1s and Pass-Throughs: Clear Up the Confusion, another person came up and said he had not decided he was going to come until he saw my topic on the agenda.

At a Business Lending Summit the month before, I introduced myself to a participant at the breakfast before the conference. He said “Oh, I know who YOU are. You are in my email box once a month and I took your entire video series on K-1s”.

While I do not think of myself as a celebrity, I take a great deal of pleasure in meeting people I have been helping for years. Welcome to the club!