I have not gotten a lot of questions about the Tax Cut and Jobs Act (TCJA) yet, but they will hit as soon as the 2018 tax returns are out. Most of the provisions took effect on January 1, 2018.

I went to my favorite source for comprehensive information on tax law, Vern Hoven of Western CPE. These illustrations are compliments of Vern. His seminar was aimed at tax preparers, but my entire focus was getting the answer to this question:What do lenders need to know?

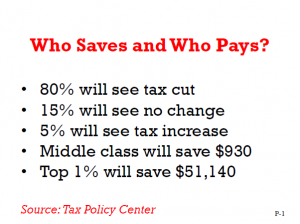

The nonpartisan Tax Policy Center estimates that because of the TCJA, 80% of U.S. households will see a tax cut in 2018, 15% will see little change and 5% will pay more. Notice the greatest tax savings is to the 1%, so if that is your client base, considering the expected reduction in 2018 and forward when you are analyzing the 2017 return makes some sense. I don’t think I would add the expected tax savings to cash flow, but I might mention it in the write-up.

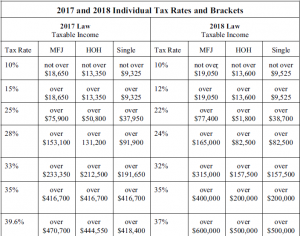

How the changes stack up:

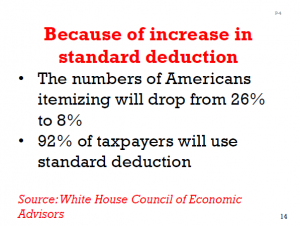

Missing information you will have to find elsewhere

Any information you are used to getting from the Schedule A will be missing for all but 8% of taxpayers. Some lenders use Schedule A to determine state income and other taxes. Some consider medical expenses or charitable contributions in determining family living. With the increase in the standard deduction, most taxpayers will get more going with the standard deduction than they got from itemizing before.

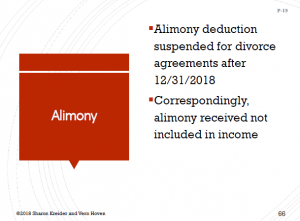

This will not impact lenders and credit analysts until we start getting the 2019 returns. For new divorces, alimony received will not show on the return so you’ll need to notice it from the borrower application. But for those divorced before 2019, it will show up. So there will still be a line, but a blank on that line does not mean they are not receiving alimony.

As always, you’ll need to see the divorce decree to decide how much longer the alimony will continue.

And, of course, the reverse is true. Just because alimony paid down in the adjustments to income at the bottom of page one of the 1040 is blank, does not mean they are not paying alimony, at least in 2019 tax returns and later. If they just don’t list it on their application, I am not sure how you’ll discover it.

Borrower returns will change even when nothing (much) changes

In future blog posts, I’ll share the list I am in the process of compiling of changes you can expect to see, both in 2017 and into 2018, that have nothing to do with business operations and everything to do with minimizing taxes. Stay tuned!