An installment sale, where the taxpayer will receive payments over time from the sale of an asset, is treated differently in the tax return. The lender needs to spot it to find out:

- how much the borrower is receiving each year

- if there are balloon payments anticipated that might impact available cashflow

- if the borrower is receiving payments as agreed

- how much longer the contract/note receivable will create cashflow

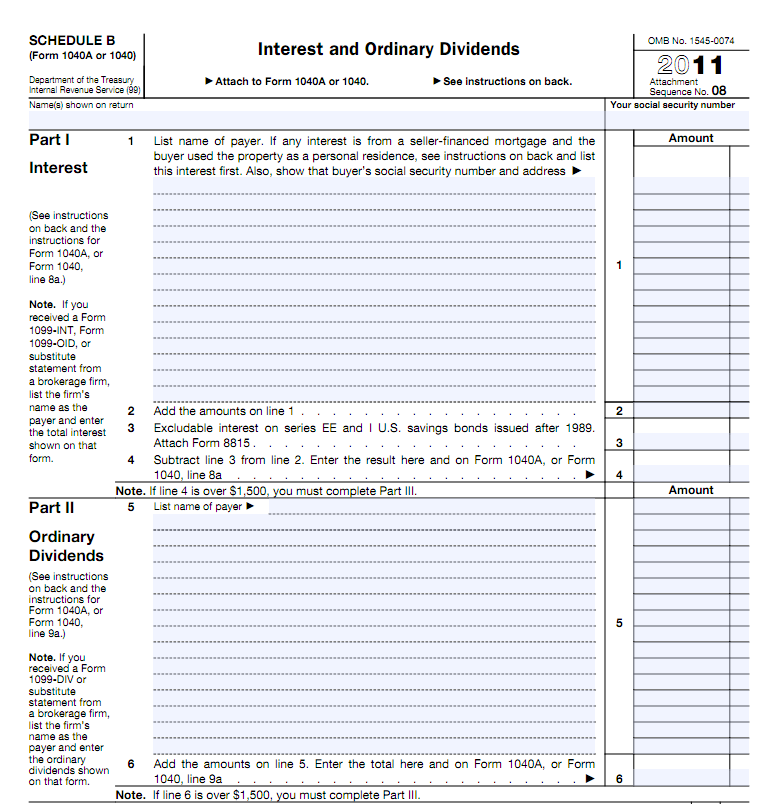

First of Two Tax Forms Needed: Schedule B Interest and Dividend Income.

Click on the image to enlarge.

The interest received from the note or contract receivable will show up on Schedule B, right along with the interest from a credit union or bank. You can usually spot it because the source does not sound like a financial institution. If ‘Linda Keith’ is listed as a payer, then the borrower likely has a note or contract receivable from me.

The amount showing on the Schedule B is only the interest. So unless I am paying interest-only, it does not show the entire cashflow provided by the note or contract.

Second of Two Tax Forms Needed: Form 6252 Installment Sales

Click on the image to enlarge.

Check Line 21: Payments received during the year NOT including interest. This is the principal payments received during the year.

Calculate amount received and then what?

You can add the interest income from Schedule B to the Installment Sale principal received from Form 6252 Line 21 to find out how much I paid (and the borrower received) in 2011. That is historical cashflow. If that is what you want, you are done.

If you want recurring cashflow, you still need a copy of the contract. From there you can determine how much longer the borrower will be receiving the payments.

How to spot a red flag: Compare the contract and the tax return

If you want to know whether your borrower is receiving payments as agreed, compare the terms of the contract to the amount calculated as received from Sch B and the 6252. If they don’t give you the same answer you have uncovered a red flag.

Perhaps the payer was not paying as agreed. And if that is the case, you’ll have to decide whether to count it going forward even if the contract says there are plenty of years left on the contract.