In the mood to be inspired? Read on. Not in the mood, scroll to the bottom of the post for some ‘cost’ definitions and why they are important.

If you have not yet presented a Junior Achievement class to school kids, you have been missing out. I was struck as I read an article aimed at business start-ups at how well the 7 year old kids had these concepts down.The article made the case for clearly understanding start-up costs versus continuing costs.

Wants or Needs

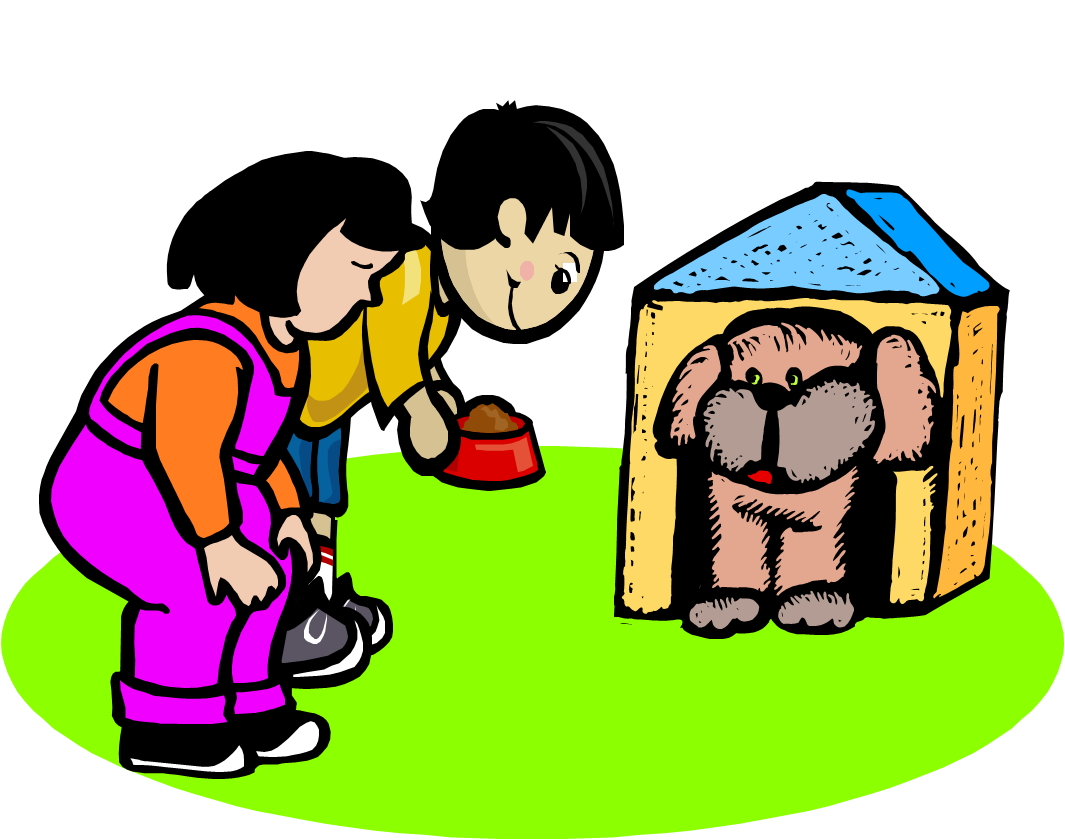

Picture this…

The first question:

Is this puppy a need or a want?

Most of the kids held up the ‘want’ card, but one held up the ‘need’ card. I had already explained that every answer was right, but I was curious.

Linda: “Joseph, you are right, of course. But I wonder why you chose ‘need’?”

Joseph: “If I was blind and that was a seeing-eye puppy, it would be a need.”

Just in case you think Joseph was a precocious child and unusual in his wisdom, let me adjust your assumptions. The next picture was a winter coat.  This time it was Amber who held up the ‘want’ card when everyone else selected ‘need’.

This time it was Amber who held up the ‘want’ card when everyone else selected ‘need’.

Linda: “So, Amber, why would a winter coat be a want instead of a need?”

Amber: “Because I already have one. I needed the first one but I do not need a second one.”

Start-up or ongoing costs…

I held up the ‘puppy’ poster again and asked what they thought they might need to budget to buy and keep this puppy. I explained start-up costs and ongoing costs.

Again, pretty sharp answers. In addition to what she could see in the poster, Sheila suggested we budget for veterinary bills. The students were pretty much in agreement until we came to the collar.

Most said it was start-up, but Jason pointed out that the puppy would grow and it would be too tight soon. Same for the ‘puppy-house’.

7 year old kids get it…how costs behave.

How costs behave is critical to budgeting…for a puppy or for a business.

- Whether they are start-up or ongoing

- Whether they are variable or fixed

- Whether they are a need or a want

Are your business borrowers smarter than a 1st grader?

I’d settle for ‘as smart’!

Cost definitions and why they matter

Here are a few cost analysis definitions and uses for your review:

- Variable costs vary with activity level. Inventory, supplies, and contracted labor are good examples.

- Fixed costs do not vary with activity level. Lease of space is a good example as long as the company does not get so big they need additional space. Because of that ‘as long as’, we talk about fixed costs in the relevant range…the likely activity range the business will encounter in the period we are considering.

- Mixed costs have some of each. For example, at some shopping malls the lease amount is a fixed portion plus a percentage of revenue. If your borrower uses temporary help, then labor costs include the fixed portion for their regular employee wages plus the variable portion for the temp workers.

- Cost of goods sold is the cost of items held for sale. That includes work-in-progress and raw materials if a manufacturing concern.

- Gross margin is revenue minus cost of goods sold. The gross margin (sometimes called gross profit) is the amount left over after those direct costs available to cover general and operating costs and provide profit to the owners.

- Contribution margin is revenue minus variable costs. It is not shown on a typical financial statement. The concept is critical, however, because if the price per item is dropped to spur sales activity, but dropped below the contribution margin, the business will lose money on each item sold. They may do this as a loss leader on purpose. But if they do this because they don’t know any better, I think the 7 year old kids could help explain it.

When your borrower is projecting future growth, or a return to profitability after the ‘great recession’, steer your conversation towards a discussion of costs to get a feel for whether they understand how their business costs behave. The better they understand this, the more likely their projections will make sense.