Greg’s question:

My borrower has a lot of real estate, and his partnership return includes a form 8825. How does the information in that form flow up to the top of the return, especially as regards depreciation?

Linda says:

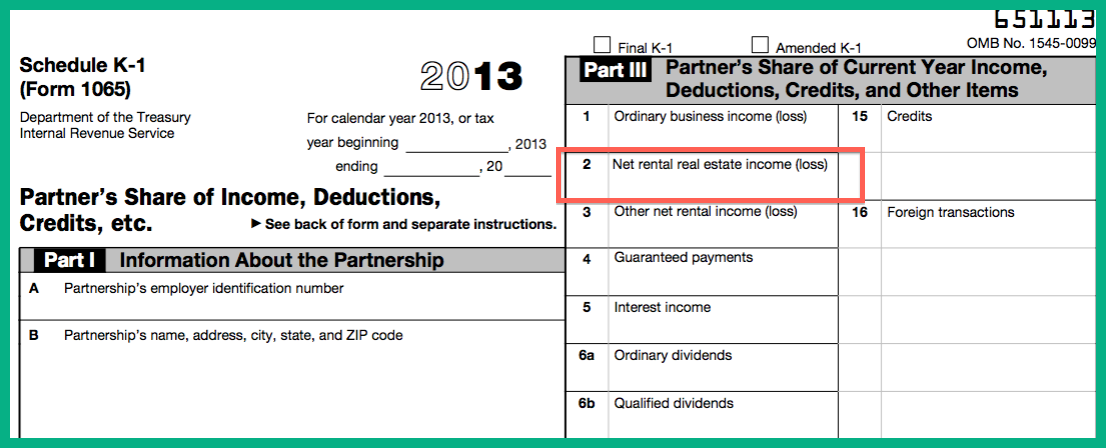

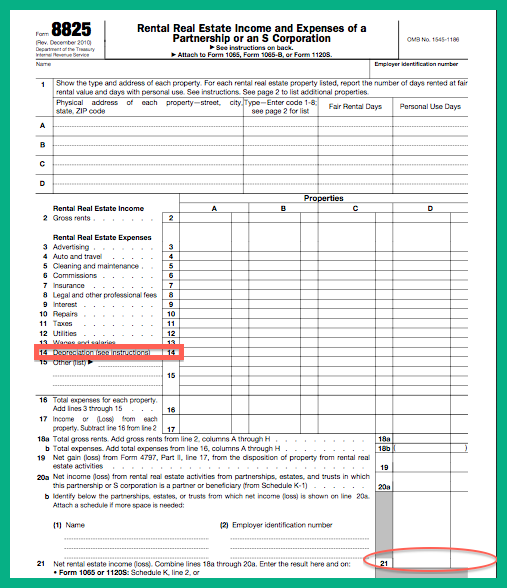

The 8825 is the real estate form and it flows to the Schedule K instead of the front page of the partnership return:

From there, the owner’s share goes to his/her personal Schedule K-1:

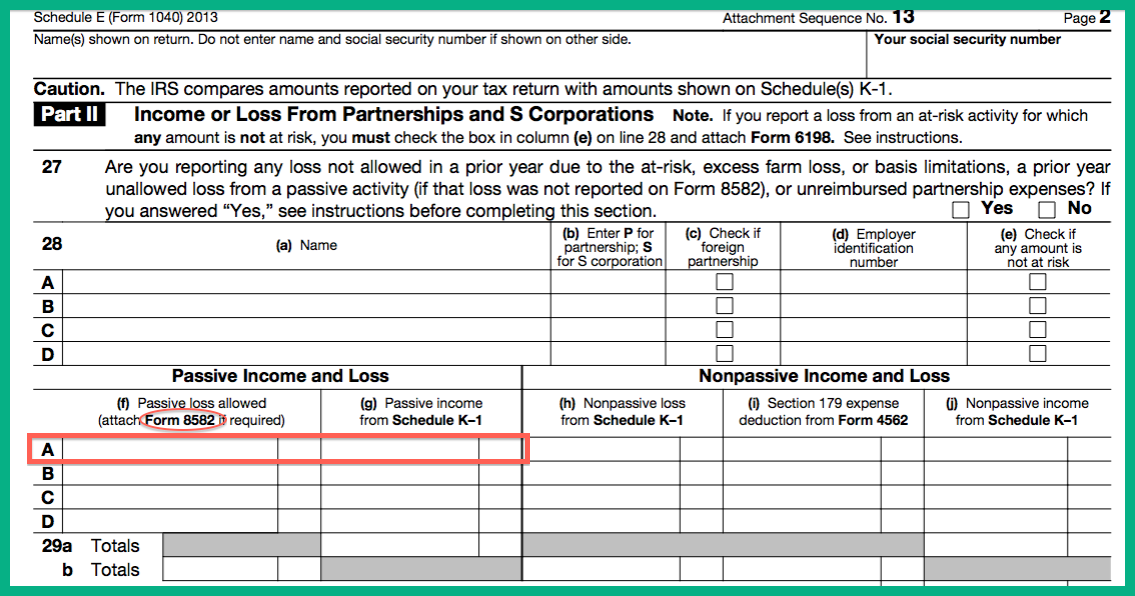

Then it flows through to the owner’s return. If the owner is an individual, their share goes to Schedule E, Page Two Line 28 column f or g. This will be the passive income and loss section on the same page that the ordinary income from the partnership/LLC flows through.

Form 8582 referred to above relates to limitations on passive losses and may result in the amount transferred to the 1040 being a smaller loss than the amount coming from the K-1.

Cash Flow Calculation

If you want to know cash flow available to the owner, start with bottom line of 8825, add back depreciation, amortization and interest and subtract the payments if you know them. If you do not, a shortcut is to leave the interest in (assuming the interest is close to the entire payment) or even to leave the interest in and subtract the current portion of long-term debt from the rental balance sheet if that is all the partnership has.

If you want to know what the owner took home in actual cash flow, use their K-1 instead of the 1065.

More on partnerships

Three of our online modules on Tax Return Analysis cover partnerships and other 1065-filing entities.

Here is the link to our demo so you can see for yourself what learning with Lender’s Online Training is like.

We have also “written the books” on Tax Return Analysis. Check out our Lender Training Manuals.