The article by Tyler Mondres in the ABA Journal is titled ‘Rosy Economic Picture Shapes Risk Outlook‘. Like farmers, bankers know that when times are ‘rosy’, worse times are just around the corner. Time to prepare.

The Office of the Comptroller of the Currency (OCC) just issued the SemiAnnual Risk Perspective Report, in which they opine that the fading stimulus from the tax cuts, the drag of higher interest rates on housing markets, shortages of skilled workers in some industries, the overhang from rapid growth in corporate debt, global trade and policy uncertainty, and slower growth abroad may temper U.S. economic growth in the next two years.

In community banking, local is often what matters most. As just one example, if you an aglender or are in a geographic area that is highly dependent on farming, the current weather disasters topping off the denial of markets due to trade wars has already tempered your growth. Or perhaps you are in a city with escalating home prices that are challenging borrowers to manage their finances and challenging your financial institution to qualify borrowers for all types of loans.

In any case, credit risk is top of mind.

What the bankers think

Last year, I commissioned the Credit Risk Readiness Report. (Request your copy here.) Through in-depth interviews and a nation-wide survey, senior credit and lending professionals identified some of their greatest concerns in maintaining or improving credit risk readiness for the next downturn.

When I read loan committee minutes I ask myself: What’s coming

Special Assets Assistant Manager, 1.5 Billion Community Bank

my way? What standards have we dropped? What guarantees have

we limited, thus limiting our recourse for what I call ‘sticks I can

swing?’ Have we eliminated or loosened up on debt service coverage,

collateral, and loan to value?

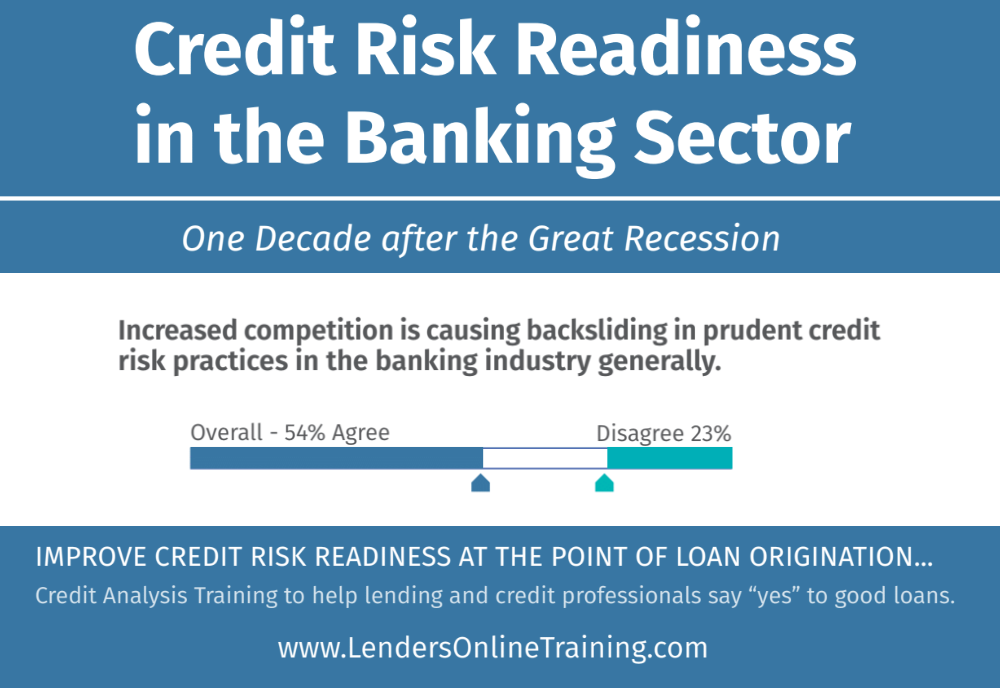

In the 32 page Credit Risk Readiness Report, senior credit professionals repeatedly express the need to maintain credit discipline, especially in the face of others in their community who are willing to overreach.

Though credit quality remains strong as measured by historical performance metrics, credit risk remains a top concern for the OCC. The Semi-Annual Risk Report noted that banks and nonbanks have continued the recent trend of easing underwriting standards as they compete for quality loans.

Tyler Mondres, Senior Manager of Economic Research, American Bankers Association

Ready or not?

Where I spend most of my time is in the trenches with our lending and credit professionals who are finding and making the loans, training them on global tax return analysis. Our less experienced professionals were in high school, some in middle school, during the ‘Great Recession’. They were not in play to learn any of the lessons learned and have started their career in a flat interest rate environment.

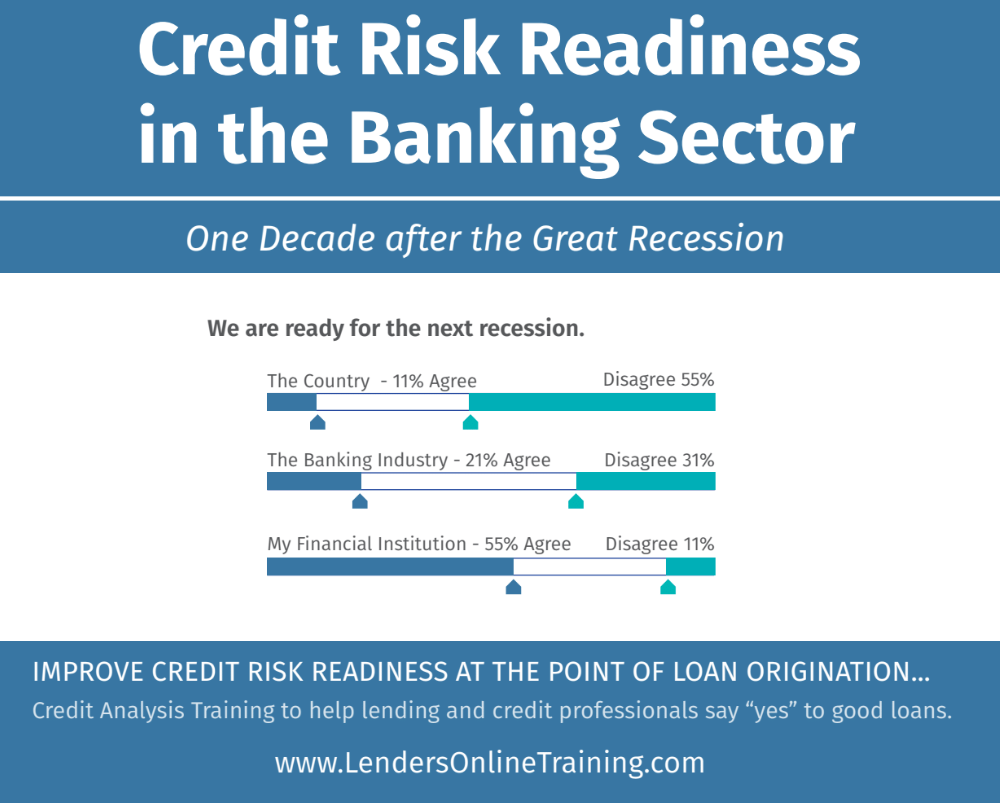

I leave you with the survey participant’s assessment of credit risk readiness. These were 250 bank and credit union Chief Credit Officers, Chief Lending Officers, Chief Executive Officers and others in the lending and credit arena. Their financial institutions included 1/3rd under $500 Million and 1/3rd over $1 Billion in asset size.

While the consensus of readiness regarding their own financial institution was much better than the country or the banking industry as a whole, note that 45% of respondents did not agree that their financial institution was ready. Is 11% disagreement a comfortable number? Is one third choosing to ‘neither agree nor disagree’ a comforting response?

Request the report

If credit risk readiness is part of your job description, you can request the full report at https://lindakeithcpa.com/crrs/. If you would like print copies for your senior staff or board of directors, request those at https://lindakeithcpa.com/contact/.

You can’t compete against stupid. But you also need to grow, win

Chief Credit Officer, $1.3 Billion Community Ban

deals and bank good customers. I believe you must be disciplined

and pick where you’re going to stretch but do it for the right reasons.

While I completely agree with this Chief Credit Officer, I would state it differently.

You have to compete against stupid. To do so requires a risk appetite that is clearly communicated to the lending and credit professionals, along with the determination to distill and pass on the lessons learned from the Great Recession. And, of course, adequate training to be sure your people can spot and make performing loans that are consistent with your guidelines and goals. There is work to do.

Linda Keith CPA, LendersOnlineTraining.com

Bankers need to talk

If you are responsible for finding banking speakers on credit risk for your regulators, your financial institution or your banking association, I can help. Here is the info. My session on“Rough Seas or Calm Waters: Credit Risk Readiness for Any Conditions” will make credit professionals think and get you talking.