Carrie’s question:

Any suggestions on underwriting lease to own companies (that lease household items, appliances, etc.). I have one that we are working on and they account for the items as fixed assets and depreciate them vs. accounting for them as inventory. I am trying to figure out where the cost of the items is ever accounted for. Yes, it is in depreciation but we add that back in the traditional cashflow.

Linda’s answer:

You are correct, this is the type of business where, when you add back depreciation, you can make a big mistake in cash flow. Another is a business that rents small garden tractors, chainsaws and the like. They buy the equipment out of cash flow, but depreciate them. Good catch.

Don’t add back depreciation????

Consider not adding back the depreciation that is associated with the equipment that they lease. Do add back depreciation on their buildings and other non-lease items. That way you are treating these items more like cost of goods sold and less like operating equipment.

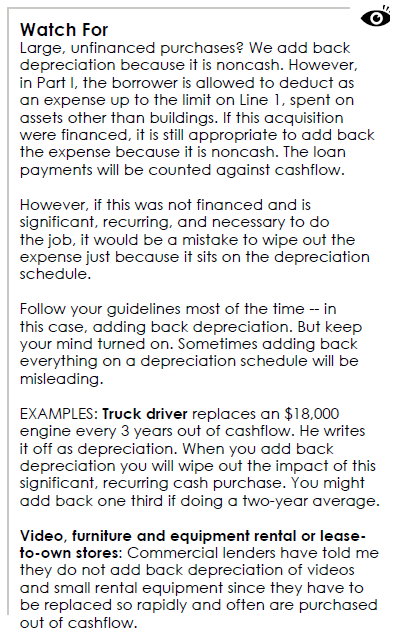

Excerpt from our 1040 Manual on NOT adding back depreciation

We just updated our manual: ‘Tax Return Analysis: Fundamentals and 1040 Review‘ to reflect the changes in forms, location of items and an update to our cashflow worksheet for 2018. Here is a screenshot of the tip on depreciation on page 73 of the manual:

So you thought depreciation was a slam-dunk

For more on depreciation and other Fundamentals of 1040 and global tax return analysis, order the manual.

Depreciation is also covered in the 22 30-minute-or-less modules on Tax Return Analysis at https://LendersOnlineTraining.com. Who knew there was more to depreciation than just an add back?

Depreciation is also covered in the 22 30-minute-or-less modules on Tax Return Analysis at https://LendersOnlineTraining.com. Who knew there was more to depreciation than just an add back?

Kudos to Carrie

It is easy to get in gear and just do what you always do, even when in this case it does not make sense. I always encourage lending and credit professionals to keep the brain turned on. For almost any guideline you have at your financial institution for global tax return analysis, I can come up with an exception that makes sense. And so can you, if you think about it.