For my loyal ‘Ask Linda’ subscribers, fair warning. This post is mostly about having fun while learning. That’s it! But if you want to learn something and skip the case for fun in credit analysis programming, skip to the bottom of the page for a hot tip on dealing with pass-through entities that are not obligated on your loan.

Content is (not the only) King!

I certainly believe that ‘Content is King’ when it comes to attending a banking conference presentation or training session. But engagement, participation and fun are royalty, too. So every format in which I convey knowledge and expertise or transform capabilities, the fun is built right in.

Online Training

The tax return analysis content is all business.

- Business, Farming and Personal Tax Returns

- Pulling qualifying income from financial statements and tax returns

- Spotting red flags and asking good questions

The delivery is state-of-the-art online learning

- 30-minute-or-less modules completely controlled by the learner

- Weekly live webinars

- Case Studies submitted, reviewed and returned with personal feedback

Having fun is required

Each week the lending professionals in our virtual training classes amass points through mastering the information on required modules (as evidenced by 80% score on the quiz), gaining 80% or better grade on submitted case studies, and participating in the live webinar.

Each week we send a very fun lego kit to the winner.

Spencer has won twice. He is working on his collection.

On the webinar where we play a Jeopardy game to wrap up the tax return analysis training, participants are instructed to give a funny answer if they do not know my answer. The funnier the better. And they can actually get points for funny!

Join us for fun (oh, and learning)

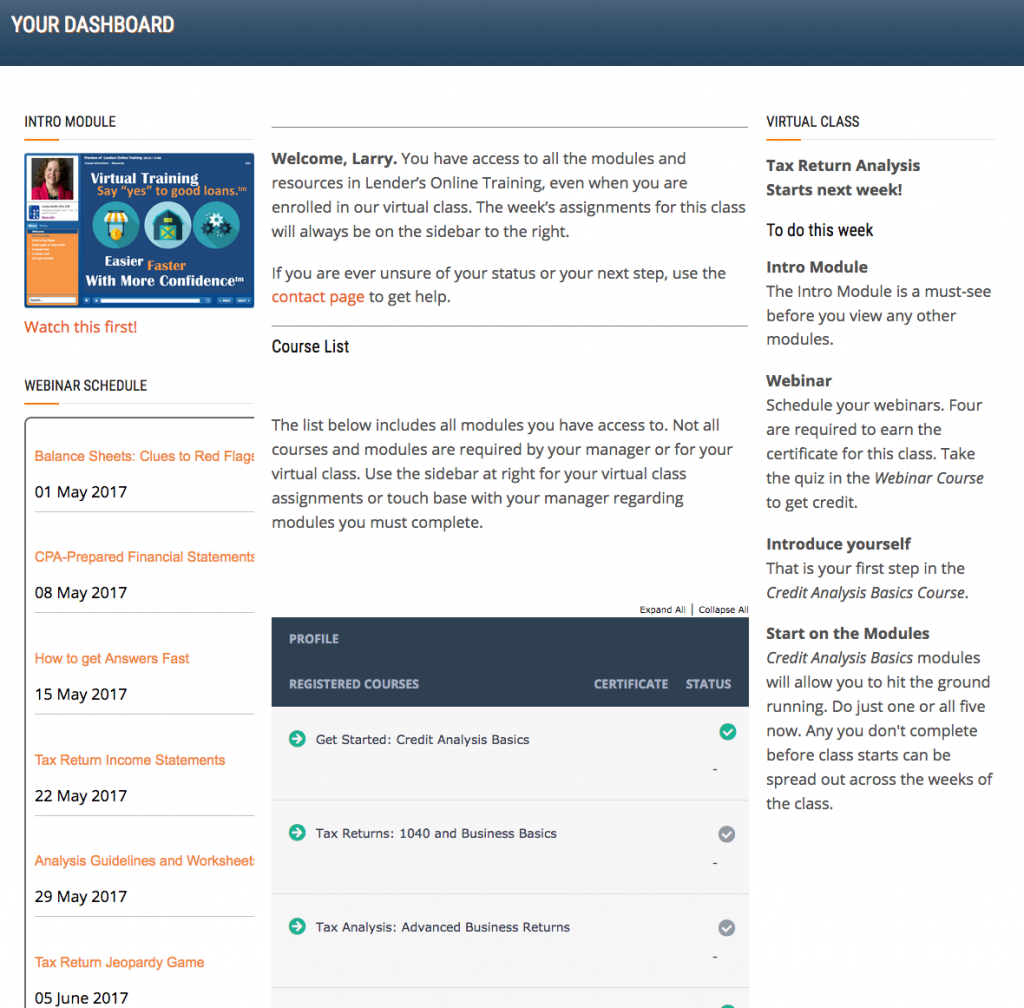

Virtual classes start every Monday and allow for self-study, four week or 8 week formats. Here is the dashboard with all the goodies.

[divider]

[space height=”20″]

Conference Presentations

In the conference presentation on ‘Turbulence Ahead: The Kayaker’s Guide to Risk Management’, Otto is learning the power forward stroke. Note the laughter and the serious thinking. They go together.

If you are planning a meeting and think funny, engaging and interactive are as important as content, click here to review our conference programs.

[divider]

[space height=”20″]

In Person Training

I had to think twice about using this picture. It is not the most flattering, but I was laughing so hard I almost fell over. And I was not alone. Everyone in the room was. And yes, the topic was business lending.

Here is the link to learn more about in-person training options. Don’t bother, though, if you think learning should be all work and no play.

[divider]

[space height=”20″]

A tip about Pass-thru Entities who are not obligated on the loan.

Okay, I can’t help but share with you an insight about pass-through entities. I just had a conversation with the Chief Underwriter at a multi-state financial institution. She shared that the guidance for pass-through entities that are not obligated on the loan is to obtain the Schedule K-1 at a minimum, and the full company return with a high percentage owner or when the income is significant for the owner/guarantor of your loan.

Then she said, when the loan officer does not get either, they have put in place a rule that requires the lender use the figure from 1040 Schedule E if it is a loss, but leave it out if it is income. I feel her pain.

Her choices are to insist on the K-1 or full return, or to create conditions under which she’ll accept the taxable loss listed on Schedule E instead. The challenge is that even a loss on 1040 Schedule E may not be as bad as the cash flow deficit.

Understand the risks

When you choose a simplifying assumption like this, just be sure you understand the risks. They include declining a loan you could have made if you obtained the full return and/or K-1. But I am hoping that if the option is to decline the loan, the loan officer will get the needed returns to see if the loan is still possible.

The other risk, though, is approving the loan without understanding the true impact of non-obligated pass-through entities. That is less of a risk with passive losses since those are more like investments than active businesses. But with nonpassive (read that as ‘active’) entities, they have likely guaranteed loans and even if they can afford their share of those, you may not know enough about their business partners to know if those partners can afford their share of the deficit or debt.

It is not my place to make your guidelines, or hers. But I sure want you to understand the risk you take when you make simplifying assumptions or allow less than full documentation of your loans. And there is really nothing funny about that!