Mandi’s question:

I recently purchased your Essentials 1040 Review and Beyond the Basics Manual. I have a question regarding the taxes and insurance shown on line 16 of the Schedule E

My customer has a 30 year fixed mortgage on her rental property. The total monthly payment includes taxes and insurance. I used the total monthly payment to calculate her existing debt. When determining the available cash flow from her rental property, would I add back in the taxes and insurance since I have already included those in her debt service?

Linda’s answer:

You are completely correct, Mandi. If the payment you use is PI (property insurance) only add back interest.

If it is PITI (principal, interest, taxes, and insurance) add back interest, taxes and insurance…everything but the ‘P’. Otherwise you will hit them twice for the taxes and insurance.

Here is a mind-bender

For readers that think this blog-post is on a simple matter, consider this. Because of the odd nature of %s, I wonder if they would be better off adding back taxes and insurance before using PITI in a debt to income calculation, or leaving them in but determining just the principal and interest and using that for the debt.

Try it out and tell me which is best. Send me your answer by email (Linda@LindaKeithCPA.com) or comment below.

Rental Cash Flow…and more

In Lenders Online Training you will find a module on rental cashflow, part of our 1040 course. The full training includes these courses:

- 101 Get Started: Credit Analysis Basics

- 201 Tax Returns: 1040 and Business Basics

- 202 Tax Analysis: Advanced Business Returns

- 301 Extra Credit

- 501 Financial Statement Basics

- 502 Financial Statement Analysis

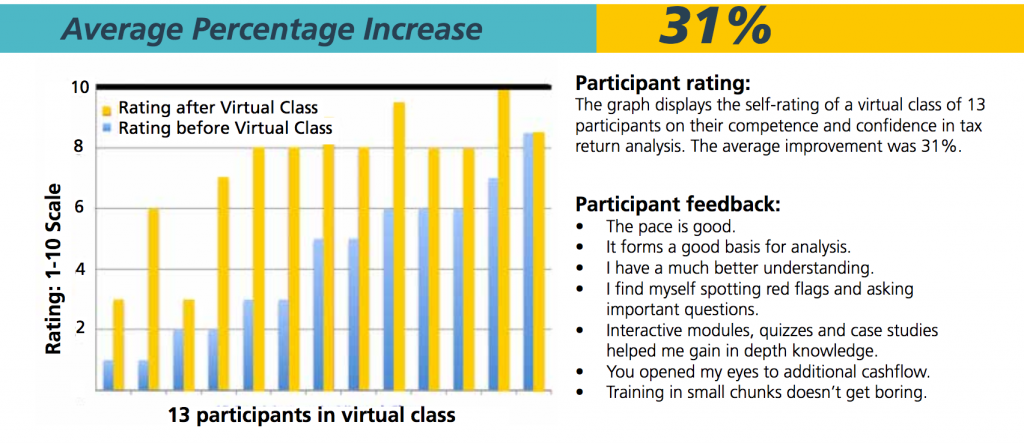

The virtual training includes live webinars and case studies with personal feedback to participants. Check it out here. This is the feedback we get from the lending and credit professionals: