Sam Thacker works with small businesses to secure all types of financing. He is often referred by bankers who either can’t do the deal themselves or realize the borrower needs help putting together the loan package. He is also the Finance Expert for AllBusiness.com. I talk to Sam at least once a month to get his latest on what is happening in small business finance.

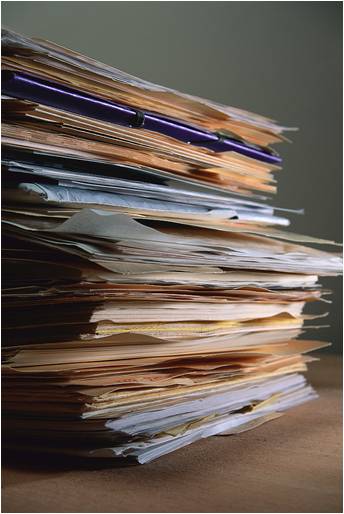

In his latest post, Due Diligence and the Thud Factor, he warns business owners that even for a loan the business lender is comfortable with you are requiring significantly more documentation to fend off an unfavorable regulator review. The thicker the file, the more it goes ‘thud’ when you drop it on the desk.

Read Sam’s 11 recommendations to the business owner to get a loan approved more quickly. Sam’s full article is definitely worth a read since he is interacting with business bankers from many different banks. Compare what you are requiring to his list.

Meanwhile, the short version:

- accurate financial records

- interim financial statement dated within the last 90 days (update may be needed at closing)

- corporate organizational records well organized

- proof of IRS 941 tax payments and reports

- “key man” life insurance.

- accurate and up-to-date capitalization table and stock transfer ledger for multiple owners

- up to date management bios

- 20% or greater owner request their personal credit report and correct discrepancies

- up to date personal completely accurate financial statements for every 20% or greater shareholder

- all information, titles, etc matches across documents

- two-page summary that explains your business model and source of revenues

Is your bank or credit union requiring all 11? Any others?