Heck, even if your financial institution has money to lend, you’ll be doing your business borrowers a service if you help them see the additional cash they may have tied up in working capital right now.

In a recent article in the Portland Business Journal, two investment bankers, an attorney and a CPA responded to the question:

With the credit crisis continuing to limit bank lending activities,

what alternative means should businesses consider for obtaining

financing?

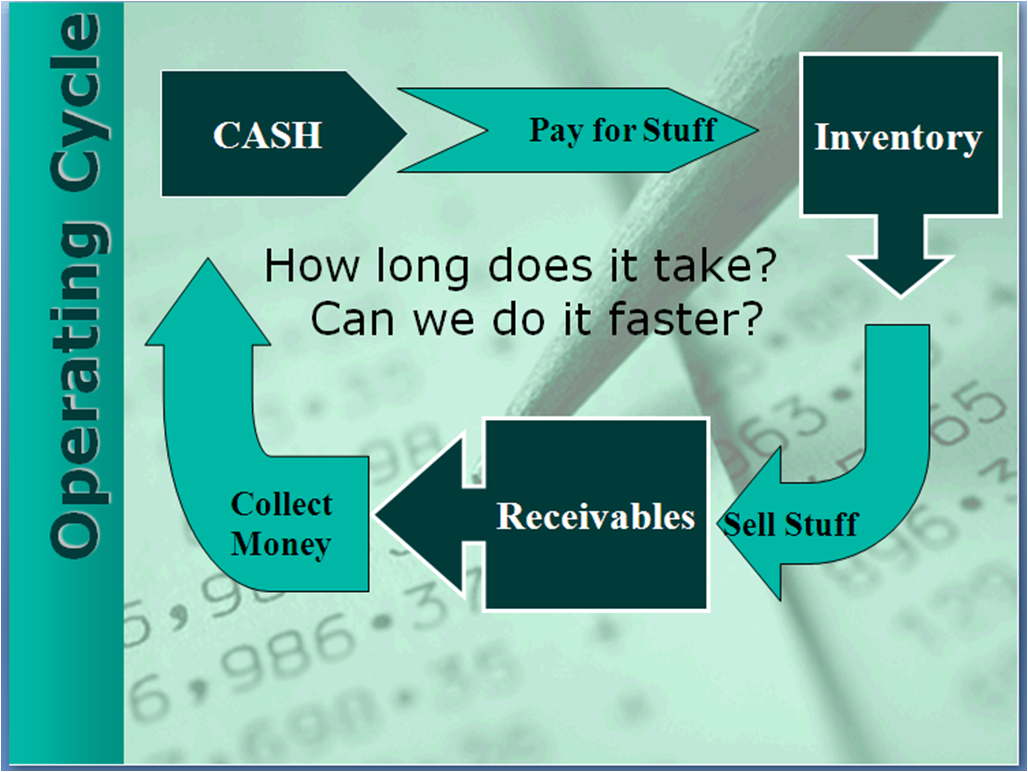

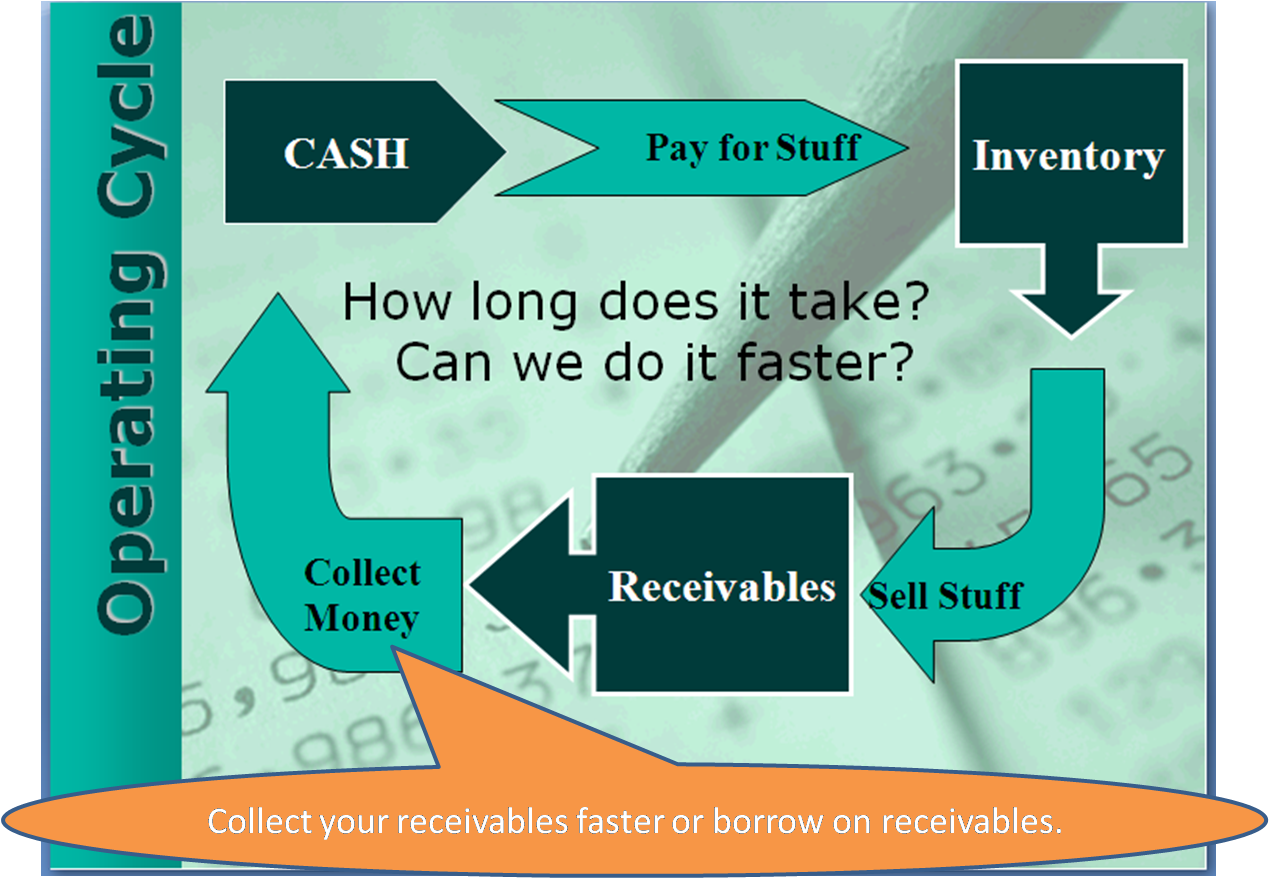

Three of the four mentioned an operating cycle focus. Let’s look at how changes in the operating cycle can free up cash. Here is a slide from my credit training on financial statement analysis:

Operating Cycle:

Be the business owner/manager for a moment. Imagine that you can ‘turn’ your cash back into cash four times a year. In other words, it takes 90 days from the time you pay your supplier for your inventory for you to sell the goods and collect the receivable. What if you could do that in 60 days instead? That would be 6 times a year instead of 4 times a year. Assuming everything else remained the same, you might be able to increase gross margin by 50%!

Be the business owner/manager for a moment. Imagine that you can ‘turn’ your cash back into cash four times a year. In other words, it takes 90 days from the time you pay your supplier for your inventory for you to sell the goods and collect the receivable. What if you could do that in 60 days instead? That would be 6 times a year instead of 4 times a year. Assuming everything else remained the same, you might be able to increase gross margin by 50%!

Or, in this environment, it is more likely that you could:

- free up cash to help cover for reduced revenues because let’s face it, everything else is not remaining the same.

- increase your capital cushion.

- improve your debt coverage ratio which would make your banker more comfortable.

- deal more effectively with the economic uncertainty as you wait to see how soon the recession will be over, and how long it will take to recover.

With less availability of credit, it is no wonder that our four experts suggest looking to this source…the business itself.

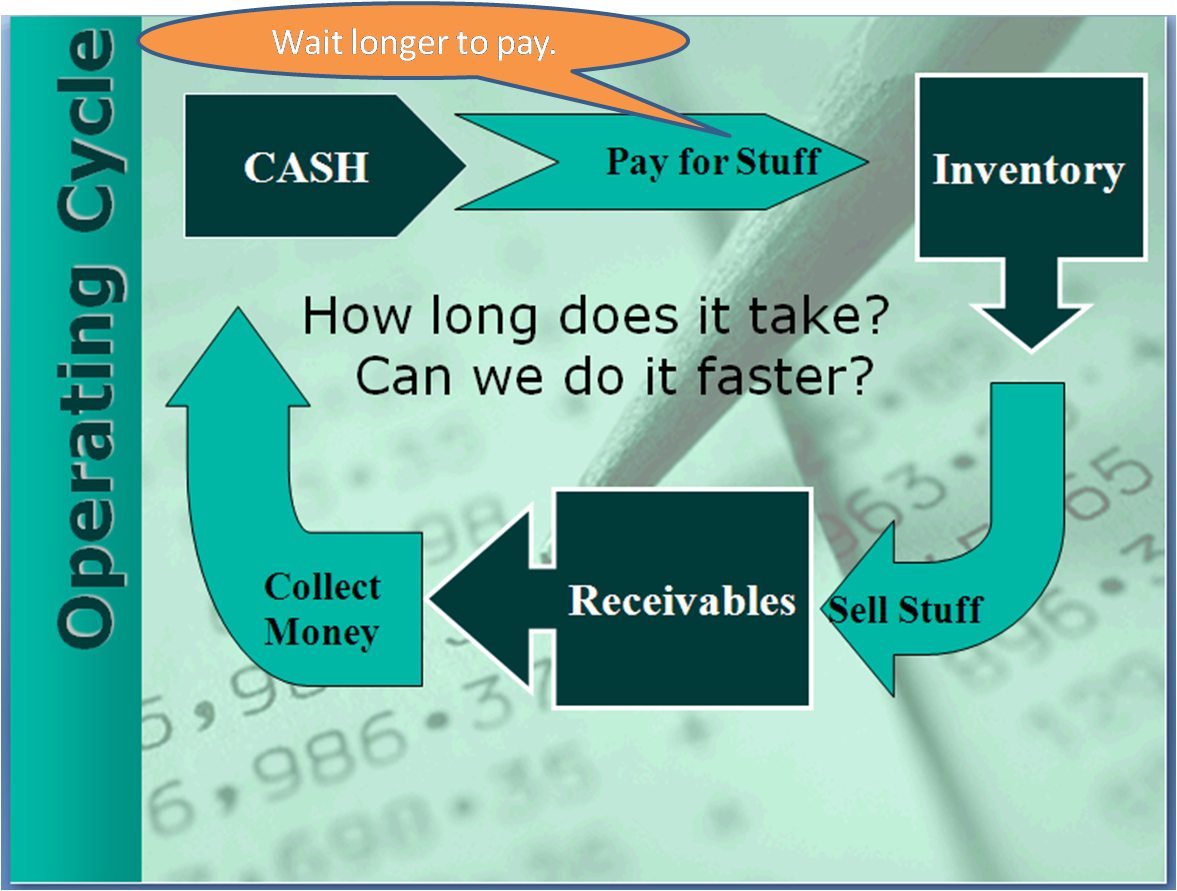

Payables:

Let’s look at the payment for the inventory first. Can you wait longer to pay? This could be as simple as not paying early, although I am pretty sure your business borrowers have thought of that one. Perhaps the business borrower can approach suppliers and ask for better terms. And if they are in the habit of paying early to capture a discount, they might reconsider if that is the best choice now.

Can you wait longer to pay? This could be as simple as not paying early, although I am pretty sure your business borrowers have thought of that one. Perhaps the business borrower can approach suppliers and ask for better terms. And if they are in the habit of paying early to capture a discount, they might reconsider if that is the best choice now.

Talking to the suppliers is a great idea for many reasons. Payment terms is one, just-in-time inventory might be another.

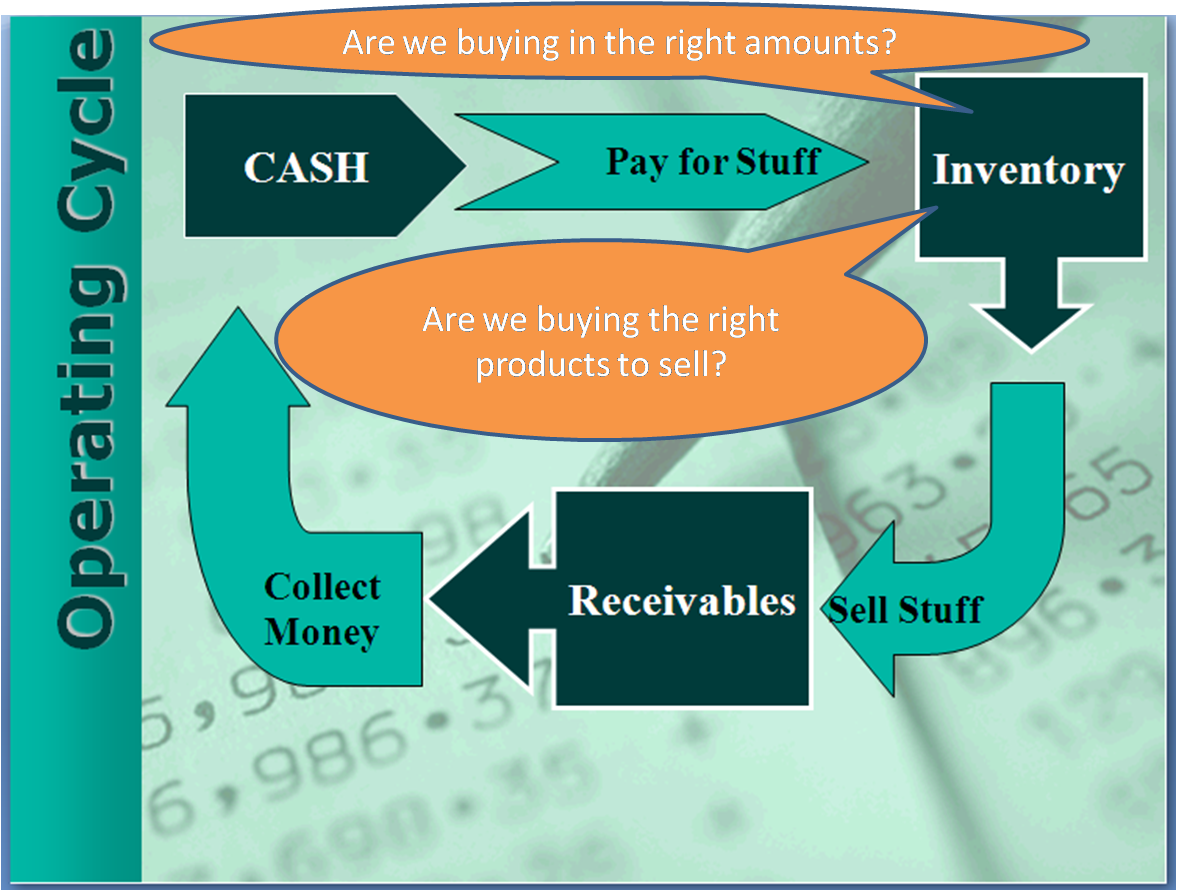

Inventory:

Still in the mindset of the business owner/manager, consider if your inventory mix is right for our current situation. Have you revised what you are buying, or the quantities, for what is selling best right now? Have you considered if some of the sidelines you had wandered into over the last few years are not the core business to attend to right now?

Your customers may never be as understanding as they are now if you only carry red, blue and green and no longer carry chartreuse.

So add to the call list…if talking with your suppliers will help you negotiate payment terms and tighten the delivery timeline, talking with your customers will help you be sure you have what they need when the need it.

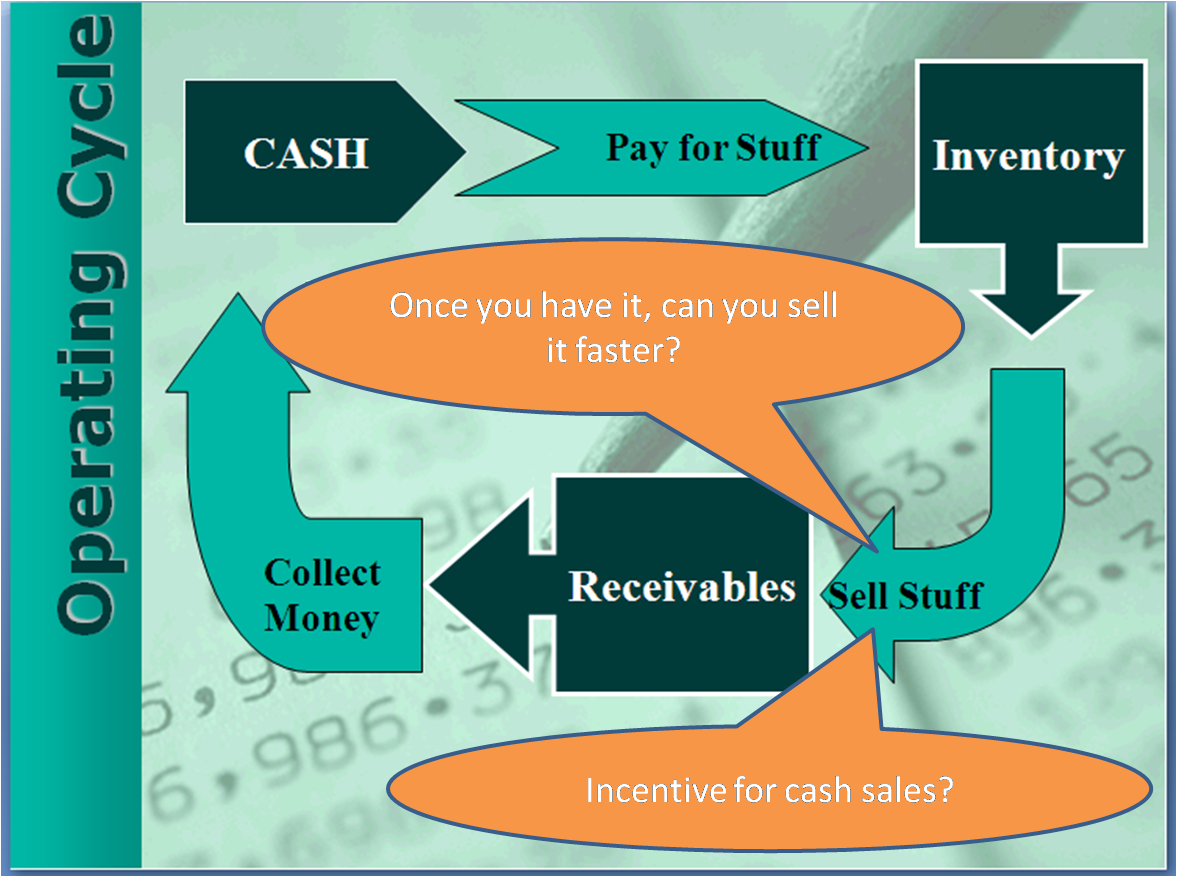

Sales:

Some tried and true ways to accelerate sales are …well….sales! If you have slower moving inventory, would it make sense to offer a discount? What about encouraging cash sales instead of credit. In my analysis training workshop, I love to show how a drop in days in receivables can be solely related to a shift from credit to cash sales.

Some tried and true ways to accelerate sales are …well….sales! If you have slower moving inventory, would it make sense to offer a discount? What about encouraging cash sales instead of credit. In my analysis training workshop, I love to show how a drop in days in receivables can be solely related to a shift from credit to cash sales.

For those of you who are knowledgeable about financial statement analysis, you may be squinting your eyes as you read that last paragraph. The reason it is true is because the banker does not have ‘credit sales’ as a numerator and uses ‘total sales’ instead. And if this paragraph made absolutely no sense to you it is time to study up on financial statement analysis. ‘-)

CAUTION: Do not encourage a business owner to drastically cut prices to move inventory without serious consideration to the impact on their brand. A short-term solution to the credit crunch could turn into a long-term disaster if the business brand or image is damaged as they come out of the recession.

Receivables:

Once the sale is made, if on credit, we still have to collect. Staying in touch with your customers is vital here again. Offering discounts for early payment may help, although many of your customers are also trying to conserve cash. If a payment is late, be on the phone immediately. Consider asking if they received the product, or how it is working for them. It will have the same impact as asking for their payment but is a much friendlier overture.

Once the sale is made, if on credit, we still have to collect. Staying in touch with your customers is vital here again. Offering discounts for early payment may help, although many of your customers are also trying to conserve cash. If a payment is late, be on the phone immediately. Consider asking if they received the product, or how it is working for them. It will have the same impact as asking for their payment but is a much friendlier overture.

How are they doing and how can you tell?

In financial statement analysis, we talk about working capital, operating cycles, Days in Payable, Days in Inventory and Inventory Turnover, Days in Receivables and Receivables Turnover. These are all ways to see how the business is managing the operating cycle and if there is tied up cash or lost profits in a cycle that could be accelerated.

Help your business borrower see these options and you’ll not only help them through the recession, but you’ll be more likely to keep them as a customer.

Need a brush-up?

Need a brush up on financial statement analysis and operating cycles? It is covered in my self-study resource: comprehensive self-study manuals .