Christine’s question:

When calculating global debt coverage ratio, what is the best way to combine business and guarantor cashflow?

Linda says:

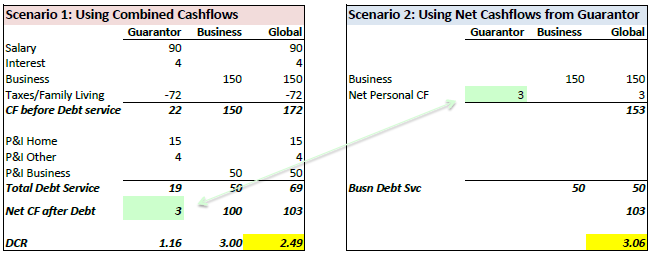

As always with algebra, there are several ways to utilize guarantor and business cashflow in a debt coverage ratio and each gives a different result. Here are the two scenarios you gave me.

First, what is DCR?

Debt Coverage Ratio is a fraction (DCR). The numerator is the annual cashflow available to pay debt. The denominator is the annual debt payments. So, a Debt Coverage Ratio of 1.0 would mean the company just has enough available cashflow to cover the debt, but with nothing left over.

Most commercial lenders want to see a DCR of 1.25 or higher. In other words, the borrower (including both business borrower and guarantors with global analysis) has 125% of the amount needed to make debt payments in available cashflow. That is a 25% cushion in case things go wrong.

Next, the assumptions and two scenarios.

The loan is made to the business and the guarantor is a 100% owner. We are looking for a global Debt Coverage Ratio of 1.3.

In Scenario 1 (see below) the business and guarantors available cashflow is combined for the numerator. The business and guarantor’s annual debt payments are combined for the denominator. The resulting DCR is 2.49. (Note: Christine has used her company guidelines as to what taxes to count against guarantor cashflow as well as the amount of family living expense to use.)

In Scenario 2 the guarantor’s debt is subtracted from their personal available cashflow to arrive at net cashflow after personal debt is covered. Then that net cashflow is added to the business available cashflow, which is then used as the numerator. The denominator is solely the business annual debt payments. The result is much better, a DCR of 3.06.

I prefer Scenario 1. Here’s why:

The reason the DCR in Scenario 2 looks odd is that by including the entire 3K net cashflows from personal, you are essentially only requiring a DCR of 1.0 on the personal side. Since we want them to have cushion both on the personal side of life and the business side, I believe that Scenario 1 is a better picture. And with global analysis generally, it is the approach I see more often.

You might ask if Scenario 2 is more accurate with a minority owner. I would say perhaps, but only if they are so minority they are not guaranteeing the loan. If they own enough for us to care about including them in the global analysis at all, it seems to me, we want their combined personal and business cashflow to provide for our target debt coverage ratio.

This time it did not matter.

In your example, I believe most lenders would be delighted with either a 2.49 or a 3.06 DCR. It becomes more critical at the margins, don’t you think?

That said, consistency from one lender/analyst to another is important so a choice should be made and everyone should follow the approved format.

Resource on Debt, Debt Ratios and Debt Shortcuts

Our self-study online resource, Lender’s Online Training, includes a module on just this topic. If you need to understand how debt is used in credit decisions, here is the link to our demo so you can see for yourself what learning with Lender’s Online Training is like.

We have also “written the books” on Tax Return Analysis. Check out our Lender Training Manuals.