I update the tax forms we use in our resource manuals and www.LendersOnlineTraining.com modules on tax return analysis yearly. It is easy to see how the 2018 forms and tax due will compare because I simply transfer the information to the next year forms. The first one I did with a married couple, Schedule C and some capital gains resulted in a reduction in their taxes of $8,500 of which $7,680 was due to the Section 199a (QBI) deduction. If they had not qualified for that deduction, the savings would have been just over $800.

The new forms are not easier!

The IRS or someone who has influence on the IRS decided we should move to a ‘post card’ size 1040. Presumably, this would eliminate the need for the simplified 1040A and 1040EZ and make completing the 1040 more straightforward. They succeeded if you are a wage earner with a bit of interest.

But they made it much worse for anyone with a business, some capital gains, other income and the like. I actually dislike the new form because I believe it is more complicated. Besides, even if it is the size of a post card, no one is actually sending it anywhere without putting it in an envelope, if they are printing it at all. Many are filing electronically and the number of pages is not relevant.

How did they fit it on a post card?

They reduced the size of the front page of the return by moving all those other items, which we still have to report if they apply, to additional supporting schedules numbered 1-5. In fact, the only income items left on page one of the return are wages, interest, dividends, pensions and social security. Here is what has moved and where:

- Schedule 1: Additional income and Adjustments to Income includes alimony received, capital gains, rentals, business and other income items. Also all the adjustments that used to be at the bottom of 1040 Page One are here, including educator expenses, 1/2 SE Tax, IRA deductions, alimony paid and the like.

- Schedule 2: Tax does not include all taxes paid. Quite a few of those made the cut for the 1040 form itself. AMT and one other tax is on this schedule.

- Schedule 3: Nonrefundable Credits includes everything but child care credit.

- Schedule 4: Other Taxes includes IRA penalties, Self-Employment Tax and most other taxes that are not standard.

- Schedule 5: Other Payments and Refundable Credits includes estimated tax payments and most refundable credits.

What’s not to like?

My biggest gripe is that in the attempt to make the basic form shorter, things are no longer grouped. Some credits are still on the 1040 main form, and some are moved to Schedules 3 and 5. Some income is still on the 1040 main form, and some is moved to Schedule 1.

Okay, maybe that is not the biggest gripe. I do not like that on the front page, instead of just being able to enter and then add numbers together, there are sub-totals that do not actually add up because the text tells you to include numbers from other schedules, notably Schedule 1. The other schedules (2-5) do have a specific line on the main 1040 form to go to.

The hassle for credit analysts and lenders

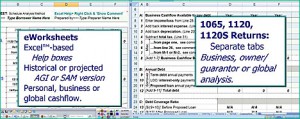

Until we get to 2021, if you are using three years in your analysis, you will have the old forms and the new forms. Time to go back to the drawing board for those of us who provide software or spreadsheets for cash flow analysis to give you the tools you need to pull information from the old and the new formats. That’s irritating!

The updated Excel Global Cash Flow worksheet

I’ll be making the changes and sending the new worksheets to everyone who already has them. If you have not purchased yours yet, click here to for more info and to purchase.

The updated Quick Reference Guide

The Quick Reference Guide covers the tax forms through 2017. I recommend you request the Guide now. That way you’ll be sure to get the updated one as soon as it is available.