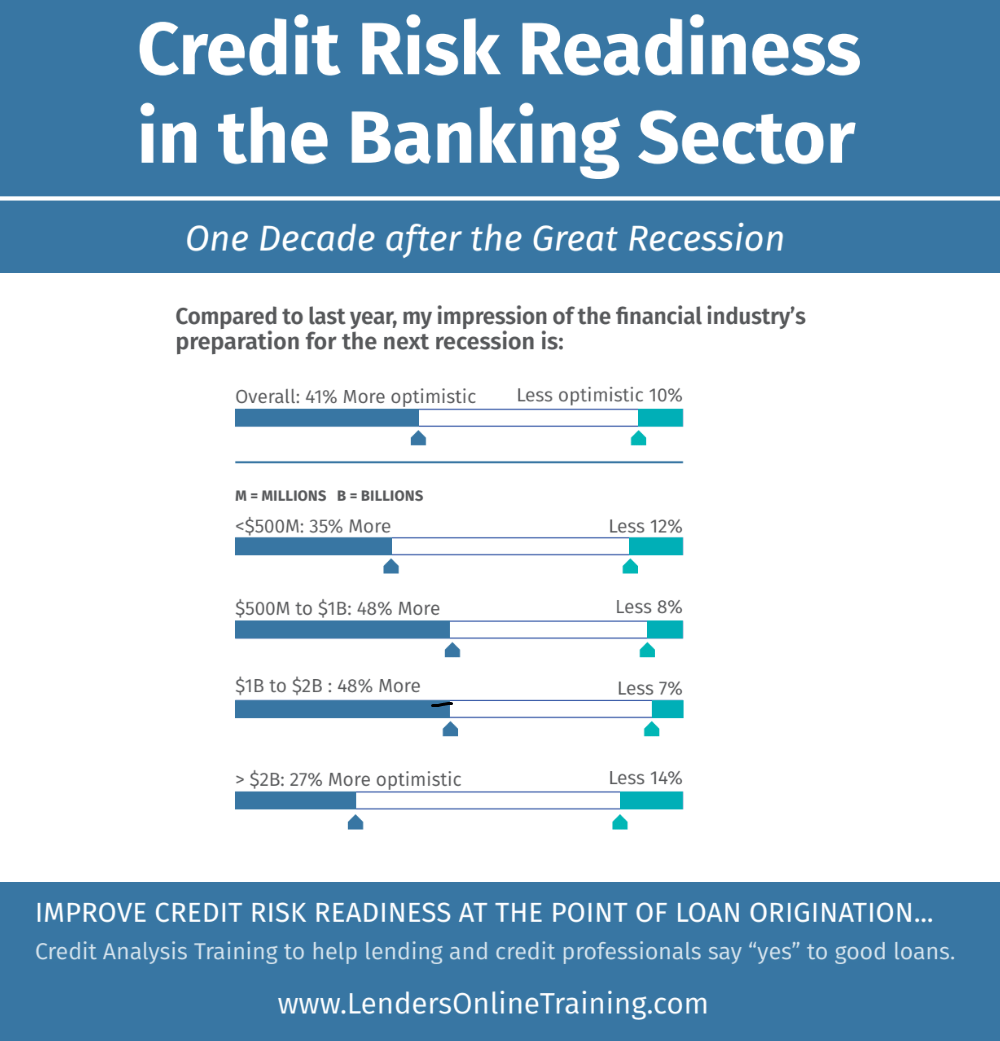

In the 2018 Credit Risk Readiness Survey, we asked banks whether they were more or less optimistic than last year.

Isn’t this interesting? Different size banks have a marked difference in optimism as to our readiness for the next recession. Are you more or less optimistic?

Read the full report

For all the results, download the 30-page Credit Risk Readiness Report at https://CreditRiskReady.com. Compare your thinking to that of bankers across the United States about biggest concerns and best practices in credit risk readiness for what is next.

#creditrisk #credit